Church of Scientology IRS Tax Exemption

Church of Scientology International (CSI)—the Mother Church of the Scientology religion—and more than 150 affiliated Churches, missions and social-reform organizations in the United States were recognized as fully tax-exempt religious organizations by the Internal Revenue Service (IRS), America’s federal tax agency, in October 1993.

“We have determined you are exempt from federal income tax under section 501(a) of the Internal Revenue Code as an organization described in section 501(c)(3).”

For nearly half a century the Church of Scientology had battled the IRS to be free from IRS harassment and to attain exemption from taxation afforded all religions in America. It was finally Mr. David Miscavige, Chairman of the Board of Religious Technology Center and the ecclesiastical leader of the Scientology religion, who bypassed all bureaucracy and in 1991 personally met with the Commissioner of the IRS to initiate an objective tax-exemption procedure in 1991.

For two years the IRS conducted the most comprehensive examination of any applicant for religious tax exemption in IRS history. IRS officials subjected Scientology Churches to the most intense scrutiny ever faced by any organization—including a microscopic review of their operations and financial records and a comprehensive review of every aspect of Church policy and practices at all levels. By the end of its examination the IRS had reviewed more than one million pages of information concerning the Scientology religion.

Dealing with the IRS and enabling them to finally see the true picture after relying on false reports for over forty years was nothing short of astonishing. But with Mr. Miscavige passionately and forthrightly presenting the truth about the Scientology religion and its operation to IRS officials, it was accomplished.

In issuing its favorable exemption rulings, the IRS necessarily determined that (1) Scientology is a bona fide religion; (2) the Churches of Scientology and their related charitable and educational institutions are operated exclusively for recognized religious purposes; (3) the Churches of Scientology and their related charitable and educational institutions operate for the benefit of the public interest rather than the interests of private individuals; and (4) no part of the net earnings of these Churches of Scientology and their related charitable and educational institutions inures for the benefit of any individual or non-charitable entity.

The IRS Tax Exemption Rulings Necessarily Found that Scientology Is a Religion and the IRS Carefully Examined This Question

Section 501(c)(3) of the Internal Revenue Code (Code) provides tax exemption for “religious, charitable … or educational” organizations. The Code provides special rules for Section 501(c)(3) religious organizations that are classified as churches, as well as for other religious organizations, called integrated auxiliaries, that are closely connected with churches.

The IRS employs a “facts and circumstances” test in determining an organization’s church status, looking at the following criteria:

- A distinct legal existence;

- A recognized creed and form of worship;

- A definite and distinct ecclesiastical government;

- A formal code of doctrine and discipline;

- A distinct religious history;

- A membership not associated with any other church or denomination;

- An organization of ordained ministers;

- Ordained ministers selected after completing prescribed studies;

- A literature of its own;

- An established place (or places) of worship;

- Regular congregations;

- Regular religious services;

- Sunday schools for religious instruction of the young; and

- Schools for the preparation of its ministers.

- Internal Revenue Manual 7(10)69, Exempt Organizations Examination Guidelines Handbook, §321.3(3) (Apr. 5, 1982).

In addition, the IRS will consider “[a]ny other facts and circumstances which may bear upon the organization’s claim for church status.” Id., §321.3(3)(o).

The Code defines an integrated auxiliary of a church as a section 501(c)(3) organization that is affiliated with a church and internally supported. Treas. Reg. §1.6033-2(h)(1). An entity is affiliated with a church if it is either (i) covered by a group exemption issued to a church; (ii) operated, supervised or controlled by or in connection with a church; or (iii) other relevant facts and circumstances show that it is so affiliated. Treas. Reg. §1.6033-2(h)(2). An organization is internally supported unless it (i) offers admission, goods or services for sale (other than on an incidental basis) to the general public, and derives more than half of its support from the public (as opposed to from members). Treas. Reg. §1.6033-2(h)(4).

The 1993 IRS exemption rulings specifically classified all of the Church of Scientology organizations that had applied to the IRS for recognition of exemption either as churches or as integrated auxiliaries of churches. Entities classified as churches included:

- Church of Scientology International (CSI), the most senior ecclesiastical body within the Church of Scientology, which provides ecclesiastical guidance to local Churches around the world; and

- Scientology Missions International (SMI), the ecclesiastical body directly responsible for ecclesiastical oversight of local missions around the world.

The CSI and SMI exemption rulings specifically identified these entities as churches, by reference to Code section 170(b)(1)(A)(i) and expressly noted that, like other churches, they are not required to file Form 990 annual exempt-organization information returns. As well, CSI and SMI received group-exemption rulings that extend their exemption rulings to all local Scientology Churches and missions in the United States, entities that operate in the same manner as Scientology Churches and missions in countries throughout the world. The Church’s spiritual headquarters was also individually recognized as tax-exempt, as were the Church’s publishing entities.

Religious Technology Center (RTC), the organization that owns the Scientology trademarks and stands as the protector of the Scientology religion, was individually recognized as tax-exempt and received its own separate ruling letter. The IRS also recognized the International Association of Scientologists (IAS), the official membership organization of the Scientology religion, as a tax-exempt organization.

In addition to ruling favorably on tax exemption, the IRS rulings made all donations by Scientology parishioners for religious services to all United States Churches of Scientology deductible against personal income taxes to the full extent permitted by law. Donations for Scientology religious services became deductible to the same extent as, but to no greater extent than, donations by parishioners of other religions to secure access to worship and similar religious rituals in their respective faiths.

The IRS could not have classified CSI and SMI, their subordinate Churches and missions, RTC and Scientology’s spiritual headquarters as churches under the Code unless it found that they possessed substantially all of the fourteen church factors listed above. Substantially all of these factors expressly require a finding that the applicant Church of Scientology is a religion. In short, the IRS could not have classified CSI, SMI and the other Church of Scientology applicants as churches under the Code unless it was satisfied that Scientology is a religion.

Thus the IRS recognition of the Church of Scientology’s tax-exempt status represents a formal acknowledgment of the religious nature of Scientology and its benefit to society as a whole.

Church of Scientology IRS Tax Exemption Followed an Examination Without Parallel in the History of Exempt Organizations

Church of Scientology IRS tax exemption followed an examination of an intensity and depth without parallel in the history of exempt organizations. IRS officials subjected Scientology Churches to the most intensive scrutiny any organization ever faced—including a meticulous review of their operations and financial records, as well as a comprehensive review of every aspect of Church policy and practices at all levels, including the most senior echelons of its management.

The IRS review resulted in hundreds of detailed questions, requiring thousands of pages of narrative and many more thousands of pages of financial records. Six teams of between four and eight agents conducted a full-time review for periods of up to ten continuous weeks. IRS agents also conducted an on-site review of books and records of Church of Spiritual Technology (CST)—the organization responsible for overseeing the Scientology Scriptures archiving project to permanently preserve the works of Scientology Founder L. Ron Hubbard—and Religious Technology Center. And by the end of its examination, the IRS had reviewed more than one million pages of information concerning the Scientology religion.

The IRS Undertook an Extensive Examination of the Church’s Compensation System

A fundamental requirement for an organization to qualify for tax exemption under section 501(c)(3) is that no part of its net earnings inure to the benefit of any private individual. The prohibition against inurement is strictly applied with respect to an organization’s “insiders”: no part of an organization’s earnings can be used to benefit any person who has a personal interest in the organization, specifically including the organization’s trustees, directors, officers, employees, members and contributors. The rule against inurement is absolute.

The IRS undertook an extensive examination of the Church’s system of compensation for both staff and third parties to ensure that neither inurement nor the potential for inurement existed. As an initial matter the IRS asked numerous questions to identify every individual “with fiduciary responsibility to prevent asset diversion” and “who would be most likely to benefit if, in fact, inurement exists.” In response to the IRS’s questions, the Church provided the IRS with a complete description of its ecclesiastical management structure, including all planned changes for the next five years and the names of all individuals holding high positions in ecclesiastical management and finance. It provided the IRS with the identity of individuals authorized to appoint members of the Church’s highest management committees. It also provided the IRS with a complete description of the workings of the Sea Organization, the Church’s religious order, as well as its internal system of ranking and the identity of those individuals holding the ten highest positions.

The IRS extensively focused on the various forms of compensation, the amounts and values involved, and the manner in which each was determined. In response to the IRS’s questions, all forms of compensation provided to staff (whether taxable or not), including pay and non-monetary benefits, and whether and how this compensation was reported to the IRS, were described.

After an exhaustive review, the IRS ruled that there was no inurement or operation for the private benefit of any individual.

The IRS Left No Stone Unturned in Its Examination of the Church of Scientology

The IRS left no stone unturned in its examination of the books and financial records maintained by these entities. For example, during the final two-year period culminating in the 1 October 1993 exemption rulings, CSI provided extensive information on the integrity of its accounting system and financial records. CSI began, of course, by summarizing the detailed information the IRS already had amassed on this subject and its extensive testing of the accounting system and records. CSI then specifically described its internal accounting and financial audit procedures—the various original entry records, reconciliations to bank statements and periodic income and disbursement summaries through the annual financial statements. CSI once again identified the basic financial controls—all receipts invoiced and banked, all disbursements by check, DV and purchase order, and the strict segregation of personnel involved at various stages of receipt, deposit, disbursement and accounting.

At the IRS’s request, CSI provided copies of all applicable financial and management policies, ultimately to include an entire eight-volume set of the Organization Executive Course, which sets forth all applicable Scriptural directives on Church management, including finance. CSI provided the IRS with copies of internal annual financial statements for the ten-year period 1981 through 1990 for CSI, RTC, CST and twenty-six other major Church organizations.

CSI also provided copies of financial statements of certain non-US Church organizations prepared by certified public accounting firms.

The IRS Examined the Details of Literally Hundreds of Thousands of Separate, Specific Church of Scientology Transactions

In the extensive examinations of the various Scientology organizations that the IRS conducted, the IRS had ample opportunity to review in detail every type of payment between and among Scientology organizations. These payments included amounts lower Churches pay to CSI for its ecclesiastical support services, payments certain Churches make to RTC when they minister Scientology’s advanced religious services to their congregations, transfers to reserves, payments for assistance in training staff, rent and mortgage payments, interest payments and loans, and the purchase of Scientology religious books and other forms of the Scripture, payments for fundraising commissions, staff compensation, and payments of all kinds to third-party vendors and professionals. In this process, the IRS examined the details of literally hundreds of thousands of separate, specific transactions.

Through these separate examinations the IRS could trace every expenditure from an organization to a corresponding receipt of the organization receiving the payment. In this way the IRS confirmed that payments made from one Scientology organization to another Scientology organization in fact went to that organization and that the funds paid were actually applied to Scientology religious purposes.

At the completion of these examinations the IRS concluded that the financial reports Scientology organizations prepare are complete, verifiable and accurately reflect the underlying transactions. Based on this extensive information about specific payment arrangements, and its satisfaction that the payments were accurately reflected in Church financial records, the IRS determined that all the inter-Church transfers of funds were consistent with the requirements for tax exemption.

The IRS was given unfettered access to every echelon of the Church’s ecclesiastical hierarchy. Thus the IRS examination was not limited to United States entities, but specifically included the financial and other affairs of Church organizations from Australia to Canada and from Europe to South Africa.

The project started at the end of the Republican administration of George H.W. Bush and continued through the Democratic administration of Bill Clinton. During this period three individuals served as Commissioner of Internal Revenue (head of the IRS). By the time the Church of Scientology received the IRS tax-exemption recognition decision, the largest administrative record ever for any exempt organization had been compiled. These Churches and their representatives had been subjected to hundreds of hours of exhaustive meetings and examined by the most senior officials over exempt organizations at the IRS National Office.

In the end, the IRS came to the only conclusion possible after such thorough examination: Scientology Churches and their related entities were organized and operated exclusively for charitable and religious purposes.

So on 1 October 1993, the United States Internal Revenue Service issued ruling letters recognizing the tax-exempt status of more than 150 Scientology Churches, missions, social-reform organizations and other entities because they operate exclusively for religious and charitable purposes. IRS religious recognition was universal and unconditional.

The Circumstances That Led the IRS to Issue the Church of Scientology Exemption Rulings Are a Matter of Public Record

Under section 6104 of the Internal Revenue Code, the application and related materials of a successful income-tax-exemption applicant are a matter of public record and open to public inspection at the appropriate office of the Internal Revenue Service.

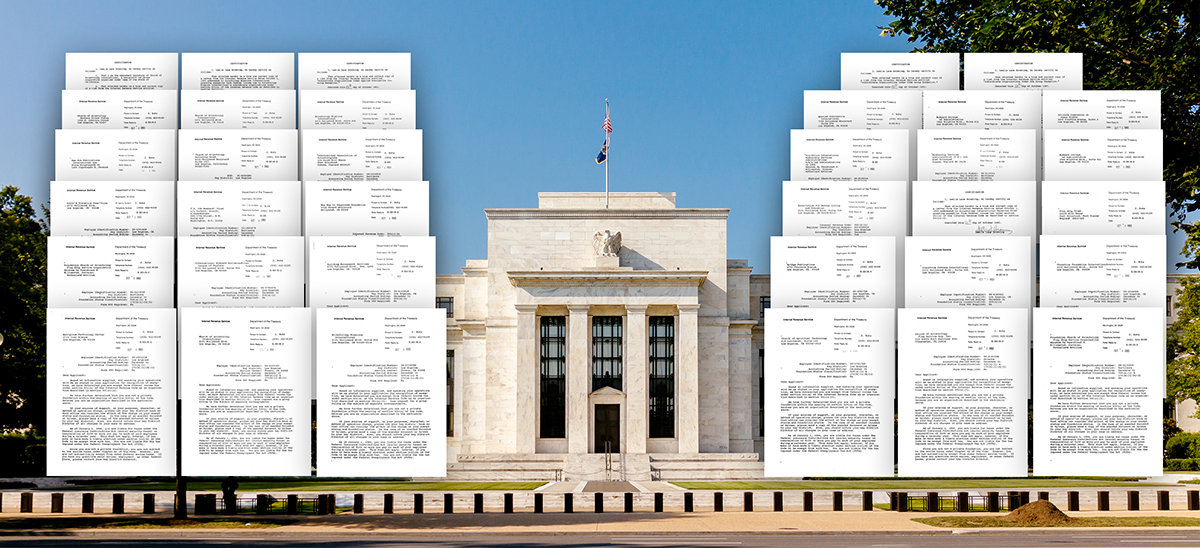

The exemption applications, papers in support of such applications and documents issued by the IRS, in connection with the applications of CSI, SMI and the other Church of Scientology organizations that the IRS recognized as exempt in 1993, are available for public inspection in the IRS National Office reading room in Washington, DC, in accordance with Code section 6104(a), and have been since the exemption rulings were issued on 1 October 1993.

These materials for the 1993 Church of Scientology exemption rulings—over fourteen linear feet of documents representing the largest administrative record of any exemption applicant—are available at the IRS National Office. Members of the public may inspect these records and see for themselves why the Churches of Scientology qualify as tax-exempt charitable organizations serving exclusively religious purposes.

IRS Staff Involved with the Church of Scientology Exemption Rulings

The IRS recognition of Scientology was a stunning blow to those who had kept the attacks on the Church going for so many decades. A number of officials in certain other countries, as well as others bent on discrimination targeting the religion and its members, attempted to discount this landmark religious recognition by spreading false reports that the IRS, one of the most feared and powerful agencies in the world, was somehow browbeaten into granting the Church of Scientology tax exemption.

These allegations are false. There is no evidence that any IRS official involved with the 1993 Church of Scientology exemption ruling was the subject of any inappropriate communications by or on behalf of the Church of Scientology seeking to harass or intimidate them into acting on the exemption application. Indeed, such an allegation is ludicrous when one considers the length of time the exemption process took (more than two and a half years) and the number, seniority and stellar reputations of the IRS personnel involved in those proceedings.

No Litigation Was Filed or Maintained to Improperly Influence IRS Administrative Actions on the Church of Scientology Tax-Exemption Cases

Likewise, allegations that the Church filed legal actions to improperly force the IRS to grant it tax exemption are false. While there was a considerable amount of litigation pending when the IRS issued the Church exemption rulings in 1993, none of this litigation was specious or brought to harass the IRS. There were a few private actions seeking damages from the IRS for claimed unlawful activities in the course of its administration of the tax laws, but most of the litigation involved (a) Freedom of Information Act (FOIA) claims to require the IRS to produce information in its records about Scientology or individual members (to facilitate the identification and correction of false information), and (b) individual income-tax cases involving the deductibility as charitable contributions of Scientology parishioners’ payments in connection with Scientology’s core religious services. All of this litigation was resolved as part of the process that resulted in the exemption rulings.

The applicable rules of civil procedure (Rule 11, Fed. R. Civ. P.) and federal statutes (28 U.S.C. §1927) both contain provisions that subject parties in litigation and/or their attorneys to penalties for taking groundless, meritless and/or frivolous positions. None of the cases between the Scientology Church or parishioners and the IRS or other government agencies that were adjudicated before the 1993 settlement agreement imposed such damages on any Church entity or parishioner who was a plaintiff in such litigation. To the contrary, the Churches of Scientology prevailed in the majority of cases adjudicated, setting many important precedents, particularly in the area of FOIA. Indeed, one Church entity was awarded attorney fees and litigation costs against the IRS under Code section 7430 due to actions by the IRS that the Court concluded were not substantially justified. See United States v. Church of Scientology of Boston, Inc. 1993 U.S. Dist. LEXIS 3895; 93-1 U.S. Tax Cas. (CCH) P50,220; 71 A.F.T.R.2d (RIA) 1485 (D. Mass. 1993)

There is no basis for suggesting that any of the cases against the IRS by Church entities or parishioners were filed and/or maintained for the improper purpose of inducing the IRS to grant exemption applications that did not warrant this favorable action on its merits. In fact, the Church of Scientology International achieved the purpose of substantially resolving all of the pending lawsuits through the settlement agreement with the IRS. This agreement included FOIA provisions by which the IRS not only produced much of the requested information at issue, but also actually agreed to notify various foreign governments and agencies of misinformation about the Church of Scientology previously communicated to them by the IRS.

The IRS Could Not and Would Not Have Issued the Exemption Rulings Had It Believed that Scientology Was Contrary to Public Purposes or the Public Good

The IRS tax-exemption rulings were fully in accord with the Internal Revenue Code and the United States Constitution. The IRS could not and would not have issued the exemption rulings had it believed that Scientology was contrary to public purposes, public order or the public good.

To establish exemption under section 501(c)(3) of the Code, an organization must prove the following:

- It is organized exclusively for one or more of the specified exempt purposes;

- It is operated exclusively for one or more of the specified exempt purposes;

- None of its income inures to the benefit of any private individual or entity;

- It does not carry on propaganda with respect to legislation as more than an incidental part of its activities;

- No part of its activities involve the participation in any campaign for public office; and

- Its purposes and activities must not violate fundamental public policy.

To establish these elements and thus obtain a favorable exemption ruling from the IRS, an organization must apply to the IRS on the prescribed form, provide all required information with the application and answer all relevant questions the IRS may have about its application. (Revenue Procedure 90-27) The 1993 IRS favorable exemption rulings to Church of Scientology International, Scientology Missions International and the other Scientology applicants followed the required procedure.

The IRS specifically examined details about the Church’s fundraising practices relating both to its proselytizing practices and its policies relating to contributions for services. The IRS has confirmed that it would not have made favorable determinations if it had found that (i) the Church impermissibly served private interests; (ii) that it had a substantial nonexempt purpose; or (iii) that it had engaged in illegal acts or violated fundamental public policy.

Also, false allegations regarding illegal activity raised by apostates and others, which the IRS had previously relied upon to take adverse action against the Scientology Churches and parishioners, were extensively investigated and dismissed as untrue by the Internal Revenue Service before recognizing that Churches of Scientology are religious charitable organizations operating for the public benefit.

Church of Scientology IRS Tax Exemption: End of Decades of Conflict

The IRS recognition brought not only an end to decades of conflict between Scientology Churches and the tax agency, but also a formal acknowledgment of Scientology’s religious nature and its benefit to society as a whole. The Churches of Scientology are fully recognized as tax-exempt religious organizations by the United States Government on the federal, state and local level and are treated no differently than any other religion.

The efforts of Churches of Scientology contributed to reforms benefiting all US citizens. The Taxpayer Bill of Rights, now a legislative reality, exists today in no small part due to the perseverance of the Churches and their parishioners, who exposed widespread IRS abuses and demanded a curb of future abuses. Their use of the FOIA ultimately brought into public view agency misconduct and computer errors that could have resulted in $1 billion in incorrect assessments. Many of the measures taken by Congress to initiate tax reforms are, to no small degree, traceable to the groundbreaking work of Scientologists.

Most importantly, since 1993, Churches of Scientology have continued to prove the correctness of the IRS exemption ruling through the extensive community outreach and assistance programs they support on an unprecedented level to improve society, reverse social decay, resolve drug addiction, educate youth and the public on their human rights, promote a secular moral code written by Mr. Hubbard, fight illiteracy, provide disaster relief, reform abuses in the mental health field, improve local communities, improve educational methods and other charitable activities.